Taxback International Joins OpenPeppol: Shaping the Future of E-Invoicing

Discover how Taxback International’s membership in OpenPeppol positions us at the forefront of digital transformation in VAT compliance.

Our tax technologies ensures global VAT compliance everywhere you do business.

Learn More Contact Us

At Taxback International we seamlessly integrate cutting-edge tax technology with experienced tax professionals to provide VAT Compliance, VAT Reclaim, and VAT Consultancy services to global businesses.

Everywhere you do business, we’re there for you.

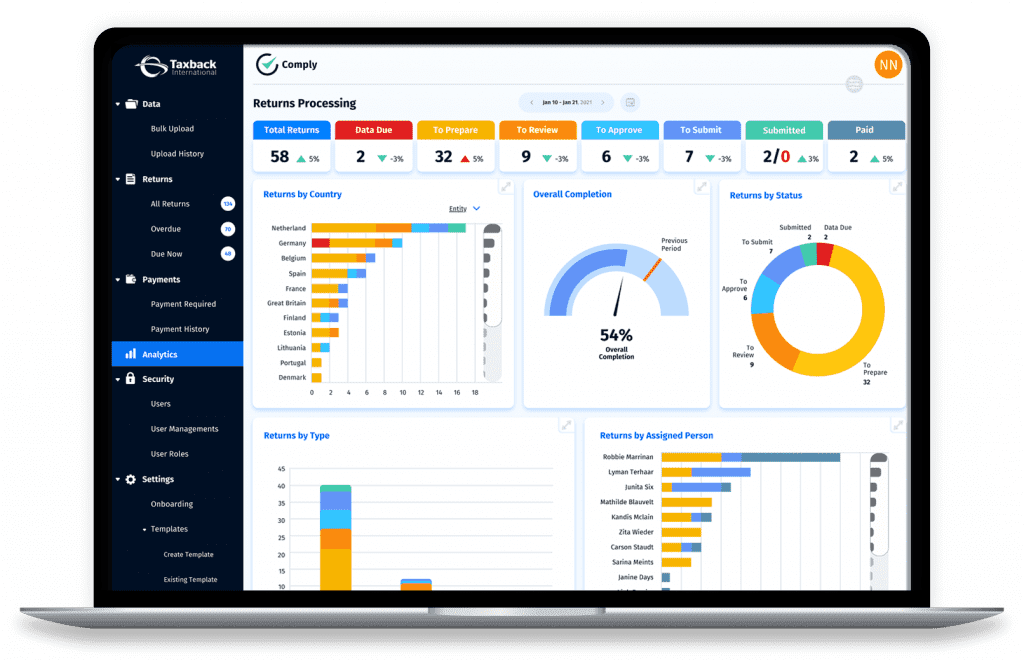

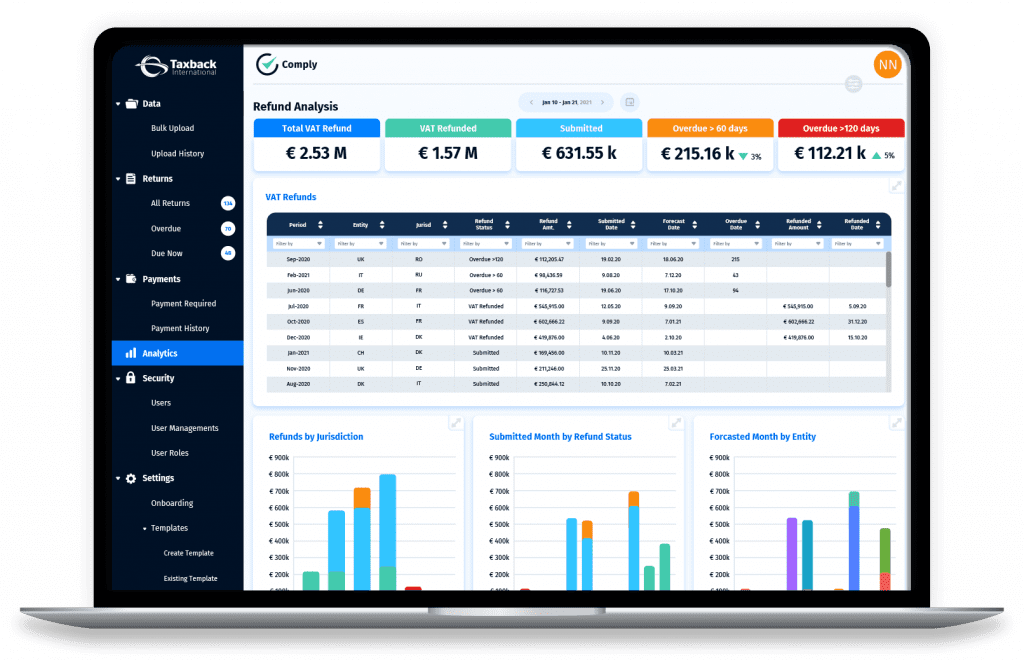

Our innovative SaaS platform – Comply – helps businesses manage complex, country-specific tax rules and regulations by simplifying and automating the preparation of VAT returns.

Comply is our innovative VAT compliance platform that streamlines the preparation, validation, approval and submission of your VAT returns to the relevant tax offices.

Taxback International has engineered Comply to adapt to evolving tax regulations. Comply is customisable to your individual complexities. Comply not only saves time but also enhances data accuracy, mitigates compliance risks, reduces costs and penalties, and boosts process efficiency.

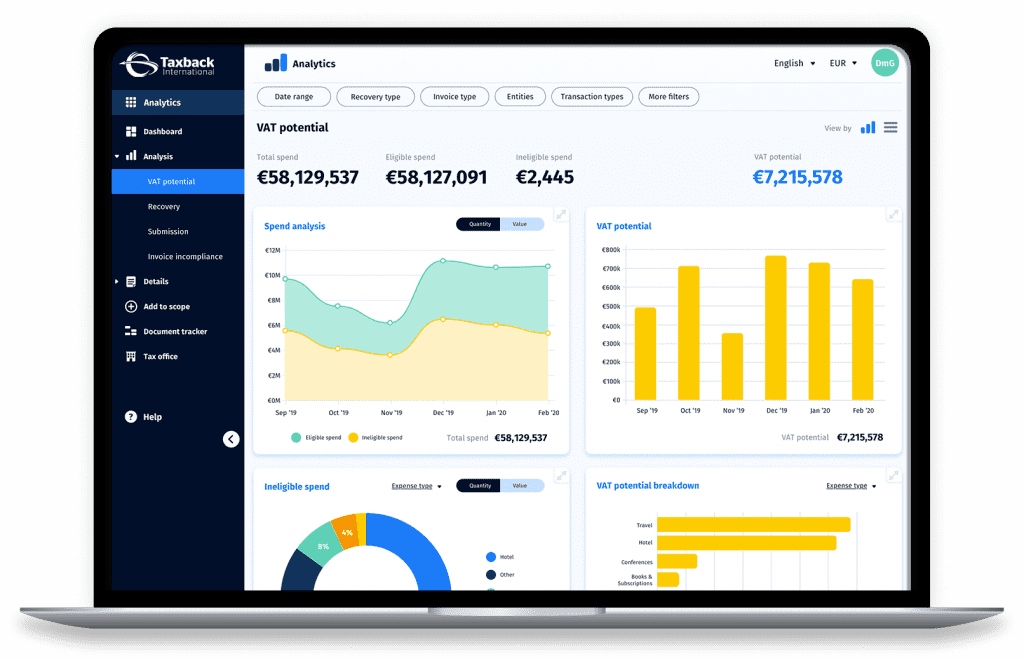

VATConnect is a secure cloud-based platform designed to simplifies the VAT reclaim process, optimizing recovery value for both Domestic and Foreign VAT Reclaim. With VATConnect, every transaction with VAT recovery potential is identified and streamlined into the reclamation process.

Through seamless integration with Expense Management Systems, VATConnect accurately identifies potential VAT recovery opportunities. By eliminating submission errors and ensuring compliance with tax office regulations, VATConnect not only simplifies the VAT reclaim process but also maximizes the value of VAT reclaims for businesses.

We offer consulting and assistance with indirect tax matters, covering a range of services including risk assessment, local tax audit support, registration, deregistration, GL reconsolidation, process documentation, data analysis, entity-specific checks, VAT matrix preparation, and data clean up.

Our team of VAT experts delivers personalized support to guide businesses through the complexities of the digital tax landscape with confidence and success.

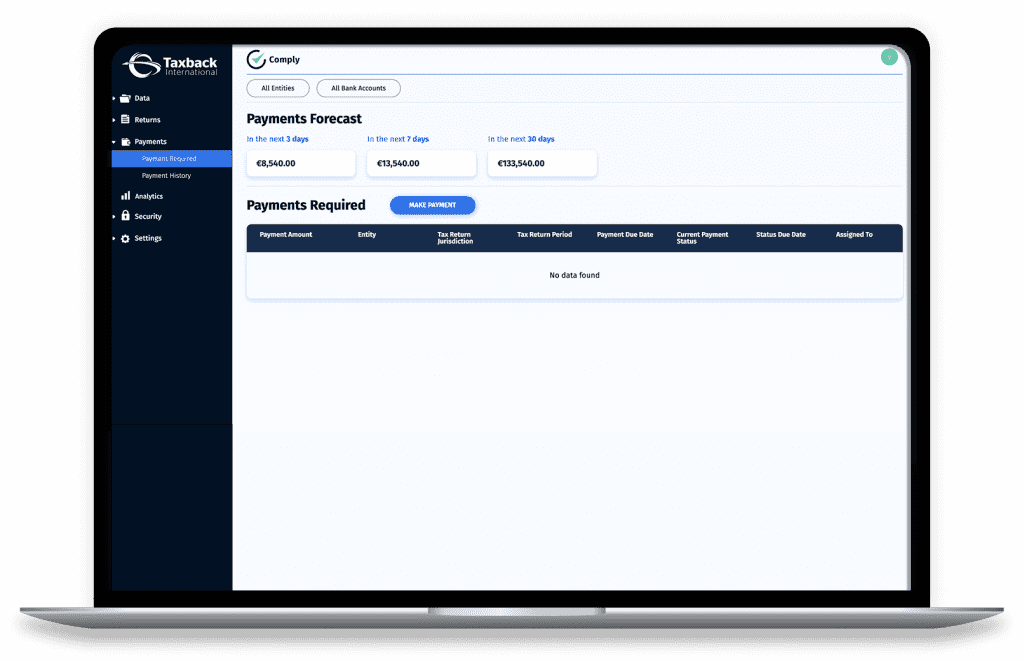

TBI Pay powered by TransferMate Global Payments, is the next generation of cross-border payments. This advanced technology is made possible through our Global Settlement Network of local bank accounts across 162 countries in 134 currencies.

ELEVATE is an innovative, collaborative, CPD-approved program exclusive to our Taxback International community. Gain valuable insights on topics that matter to you from fellow industry professionals. Special thanks to this year’s guest speakers from Ancestry, Metso, Medtronic, WTS Global, Meta and TransferMate who presented insightful seminars and panel discussions around VAT in the Digital Age (ViDA).

Watch ELEVATE 2023Taxback International provides indirect tax consultancy and technology to global businesses.

See what some of our clients have to say about working with us.