E-Invoicing’s Critical Role in EU VAT Reform

The Rise of E-Invoicing

The adoption of e-invoicing for B2B transactions by both businesses and tax authorities is gaining momentum due to several key factors:

Technological Advancements

Businesses and tax authorities are increasingly leveraging new technologies to replace manual processes, enhancing efficiency and accuracy.

Process Streamlining

There is a continual push to make business operations more efficient, freeing up resources from administrative tasks and redirecting them toward value-added services.

Cost Reduction

Transitioning from paper-based invoicing to e-invoicing significantly lowers the costs associated with invoice handling and accelerates the payment cycle.

Success of B2G E-Invoicing

The effective implementation of e-invoicing mandates for business-to-government (B2G) transactions has encouraged both tax offices and businesses to consider similar approaches for B2B transactions.

Combatting VAT Fraud

The recent notable decrease in the EU VAT gap—from EUR 99 billion in 2020 to EUR 61 billion in 2021—is partly due to real-time or near real-time reporting of transactional data, achievable through e-invoicing and digital reporting.

ViDA

Introduced by the European Commission in December 2022, ViDA’s first pillar focuses on real-time digital reporting for intra-community transactions and aims to establish a harmonized e-invoicing framework across all EU Member States.

ViDA Pillar 1 Key Objectives

- The introduction of a harmonised, mandatory, transaction-based digital reporting requirement (DRR) for intra-Community transactions, replacing monthly and quarterly recapitulative statements.

- Optional Reporting for Domestic Transactions, allowing Member States discretion in applying DRR domestically.

- E-Invoicing as the Default System for issuing invoices, standardizing electronic invoicing practices across Member States.

- Centralized Database for Information Exchange between Member States on intra-Community transactions (central VIES).

To Achieve These Objectives, ViDA Sets Out That:

- E-invoices must be in a structured electronic format, ensuring consistency and facilitating automated processing.

- E-invoicing is mandatory for all transactions subject to reporting obligations, supporting transparent and timely data sharing.

- EU Standard for E-Invoicing: The European standard must be used for e-invoicing and transmitting information to tax authorities.

- Member States must accept invoices that comply with the European standard.

- Member States may permit traders to use alternative data formats, provided these formats are interoperable with the European standard.

Member States must ensure that electronic invoices contain all information required by the VAT Directive and comply with the established technical standards for electronic invoicing. They may permit taxable persons or intermediaries to perform these compliance checks.

Issuance Dates

The issuance date for invoices related to cross-border supplies is set at 10 days following the chargeable event or upon receipt of payment on account. For domestic supplies, however, the issuance date remains unchanged.

Additional Content Requirements Include:

- A reference to triangular transactions when the recipient of the goods is responsible for paying the tax.

- For corrective invoices, a sequential number must be added to identify the corrected invoice.

- The supplier’s bank account number, virtual account, or any other identifier through which the recipient can pay the VAT should be provided, with the option to include multiple numbers if needed.

Reporting Requirements

Invoice data should be reported to the tax office at the time the invoice is or should have been issued. For self-invoices, the data should be reported within 5 days of the time the invoice is issued or should have been issued; for customers, the invoice data should be reported within 5 days after the invoice is received by the customer or a third party on its behalf.To meet all of these requirements, the EU Commission and Member States are evaluating which e-invoicing and reporting models to adopt. For domestic reporting, Italy and Romania have already implemented centralized reporting systems where invoices are transmitted through a centralized government portal, and Poland is set to introduce a similar model.Other Member States, such as France and Belgium, plan to roll out their domestic e-invoicing and reporting models in 2026 using a 4 or 5 corner approach. It is likely that other Member States will also follow these models in order to align with the ViDA proposal’s requirements and the following ViDA timeline:

ViDA Timeline

- July 2030: Full implementation of real-time digital reporting based on e-invoicing for intra-community transactions, with harmonization of domestic digital reporting requirements.

- January 2035: Member States with existing digital real-time reporting systems as of January 2024 will need to harmonize with ViDA standards.

The EU Commission clarifies that “Member States having a domestic digital real-time transaction-based reporting system in place on 1/1/2024 or obtained a derogation prior to that date or having adopted legislation for the implementation of such a system before that date where no derogation was necessary can keep them until January 2035 (for domestic transactions).”

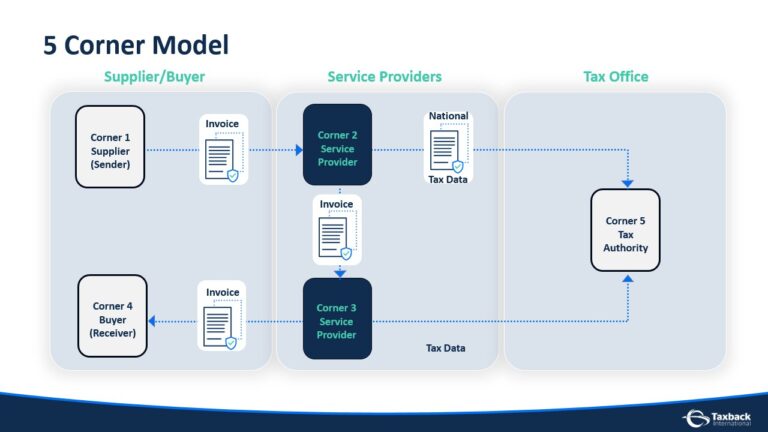

The 4 and 5 Corner E-invoicing and Reporting Model

In recent years, Peppol has concentrated on developing a 4 and 5 corner model that allows e-invoices to be generated in one system and received in another. This model operates through a network of interconnected service providers, enabling senders and receivers to independently choose their respective providers. OpenPeppol, a non-profit organization established in Belgium, currently has 641 members across 41 countries. It serves as a “global ecosystem” that connects organizations through a network of Peppol-accredited service providers.

While Peppol facilitates the exchange of electronic business documents, it does not function as a portal or provide exchange services directly. Instead, it provides a set of document specifications that integrate global business processes and manages governance to ensure interoperability.Recently, Peppol launched its “ViDA Pilot” to demonstrate the Peppol five-corner e-invoicing and reporting model as a harmonized solution for ViDA Pillar 1. The timeline for this initiative includes several key milestones:

- Autumn 2024: Development of the project plan, recruitment of participants, and collection of technical and business requirements from stakeholders.

- First Half of 2025: Peppol aims to complete the initial design of the Digital Reporting Requirement (DRR) architecture, laying the groundwork for subsequent testing.

- Early Second Half of 2025: The pilot project will move into the testing phase, focusing on validating the architecture and specifications.

Taxback International are members of Peppol, learn more about what this means.

Conclusion

We continue to follow developments in relation to ViDA Pillar 1 as discussions are ongoing on invoice semantics, syntaxes, and reporting models. We also continue to track the development of domestic mandates across Europe to see if some level of harmonization can be reached, possibly through the wider adoption of the 4 and 5 corner models. These headings will help readers navigate through different sections easily while maintaining your original content intact.

Stay informed about the latest developments in VAT regulations and how they may impact your business. Subscribe to our newsletter for updates!