Global VAT Guide: October 2024

The October edition of the Global VAT Guide features comprehensive updates on VAT regulations and developments from Belgium, Bulgaria, Ireland, Slovakia, Costa Rica, India, Mexico, South Africa, Switzerland, Thailand, Turkey, and the United Kingdom.

Belgium

Previously, it was announced several changes would be introduced in relation to Belgian VAT filing requirements that aim to improve the collection of VAT.

The effective entry into force was planned to be 1 January 2024 but that this was postponed until 1 January 2025.

Below is a synopsis of some of the key changes:

- The due date to file Quarterly return will be extended from 20th to 25th of the month that follows the reporting period end

- The due date to file Monthly return remains unchanged. This is the 20th of the following month;

- The option to pay tax due by Direct Debit is being introduced;

- Monthly VAT refunds may be requested by all that file monthly returns on the condition that the returns are filed on time in preceding 6 months

- Currently in general a refund may be requested on quarterly basis, or monthly upon specific authorization;

- “VAT Provisions Account” (Compte-provisions T.V.A) replacing the current account of taxpayer’s VAT credits and Debts Account;

- “Substitute VAT return Proposal” (Proposition de déclaration de substitution) will be automatically generated in case no VAT return submitted within 3 months following the respective reporting period, and indicating VAT equal to the highest of the reported in last 12 months VAT amount due, subject to a minimum of € 2,100;

- Timeframe to respond to a tax office request for information – 1 month may be shortened to 10 days (currently no legal ground specifying timelines to respond);

- Late filing of a return may result in extended statute of limitations to the 31 December of the fourth year following the year in which the VAT became payable.

Bulgaria

The Bulgarian National Revenue Authority aims to run a pilot on OECD model based SAF-T in the first half of 2025 for voluntary filing of large taxpayers.

The technical documentation and more details have been posted on the Bulgarian National Revenue Agency website.

Every part of the SAF-T document will have to be submitted at different frequencies:

- On monthly basis

- The General Ledger, Sales and Purchase invoices, Payments

- On yearly basis

- Assets

- And on demand by the Agency will be the accounting information

It is yet to be clarified by the National Revenue Agency if this will discontinue the filing of the current sales and purchases ledgers.

It is specified that the phases for implementation will begin in January 2025:

- Pilot testing for the first six months, requesting voluntarily filing by large taxpayers;

- Mandatory filing for large enterprises (within the meaning of the Bulgarian Accountancy Act), registered as large taxpayers beginning 12 months after adoption;

- Mandatory filing for all large taxpayers beginning 24 months after adoption;

- Mandatory filing for medium taxpayers beginning 36 months after adoption;

- Mandatory filing for small, medium and large enterprises that are not qualified as large or medium taxpayers beginning 48 months after adoption; and

- Mandatory filing for micro-enterprises, registered for value-added tax (VAT) (except for entities that hold a VAT number in Bulgaria by are not established in Bulgaria through a PE or branch), beginning 60 months after adoption

Further information will be posted by the NRA and E&Y on the data requirements and the technical requirements that are in line in order to implement the SAF-T.

Ireland

VAT Registration Threshold

On 1 October 2024, Budget 2025 was announced.

From 1 January 2025, the below changes will come into effect:

- The VAT registration threshold will be increased from €80,000 to €85,000 for goods; and

- The VAT registration threshold will be increased from €40,000 to €42,500 for services.

Irish Revenue published a new VIES Trader Manual

The Irish Revenue published a new VIES Trader Manual on 10 September 2024, replacing Version 12 of the VIES and Intrastat Traders Manual.

It provides an overview of the VAT Information Exchange System (VIES), focusing on key topics for intra-Community suppliers and those filing a VIES Statement for the first time.

The manual also includes a detailed guide on submitting and correcting VIES Returns via the Revenue Online Service (ROS).

Slovakia

As mentioned in a previous newsletter, the Slovakian Government is preparing significant changes, effective from 2025.

Below are some of the changes that will be introduced:

- The option to apply reverse charge on import VAT

- from 1 July 2025 by a Slovak established businesses

- from 1 January 2026 by non-established businesses

- VAT registration timelines changes

- Non-established businesses should register within 5 days from the taxable event on occasion of which registration liability arose

- Late registration reporting formalities

- Late submission sanctions will apply individually to the VAT return and control list.

- Possible input VAT recovery on intracommunity acquisitions with no invoice.

Costa Rica

On 30 July 2024, the Directorate of General Taxation issued Resolution 0018 on the Implementation of a tool for verifying the status of electronic receipts.

The tool could be accessed via taxpayers’ ATV accounts and via no account for the public.

To make the query, you must have the 50-digit code (Clave) available on the receipt you want to verify and check the “I’m Not a robot”, where a captcha and a check will be displayed. Subsequently, you must press the “Consult” button.

In a positive result, some characteristics of the receipt can be viewed electronically, including the Document Type, Number, Status, Date, and Issuer tax code.

India

On the 10 September 2024, the Central Board of Indirect Taxes and Customs published Circular No. 230/24/2024-GST related to comprehensive advertising services provided by an Indian advertising company to a foreign client.

The place of supply depends on whether the Indian advertising company is considered an intermediary between a foreign client and a local Media company.

- If no agreement for the supply of services exists between the local media company and the foreign client, the advertising company is not considered an intermediary. The services qualify as export of services and the place of supply is where the foreign client is (outside India)

- If the local Media company directly invoices the foreign client for providing the media space and broadcast of the advertisement and the foreign client remits the payment for the said services directly to the local Media company, the advertising company is considered an intermediary and the place of supply is where the provider is (in India).

Mexico

Mexico Tax Authority recently started requesting foreign digital service providers to meet two new conditions when registering for the first time.

- Companies must clearly state in their legal documents that their primary business activity is to offer services though technological platform, whether for selling, leasing gods, or offering services; and

- Companies must provide an affidavit signed by a legal representative that outlines services they offer, the website they use, and their main business address.

These changes will make the registration process bit more complicated.

Companies that are already registered to pay VAT in Mexico don’t need to change their documents, however the new registrants must carefully check and possibly update their paperwork to meet the new requirements before application to ensure compliance.

South Africa

South Africa’s National Treasury is implementing measures to implement the legislative changes in the VAT treatment of Electronic Services Providers announced in Budget Speech 21 February 2024 upon presenting 2024 Budget.

On 31 August 2024, a consultation took place in relation to the introduction of reverse charge for B2B digital services by non-residents. This is due to come into effect from 1 April 2025.

This would shift VAT reporting to South African businesses, ending the need for non-resident suppliers to charge VAT or remain registered in the country.

Switzerland

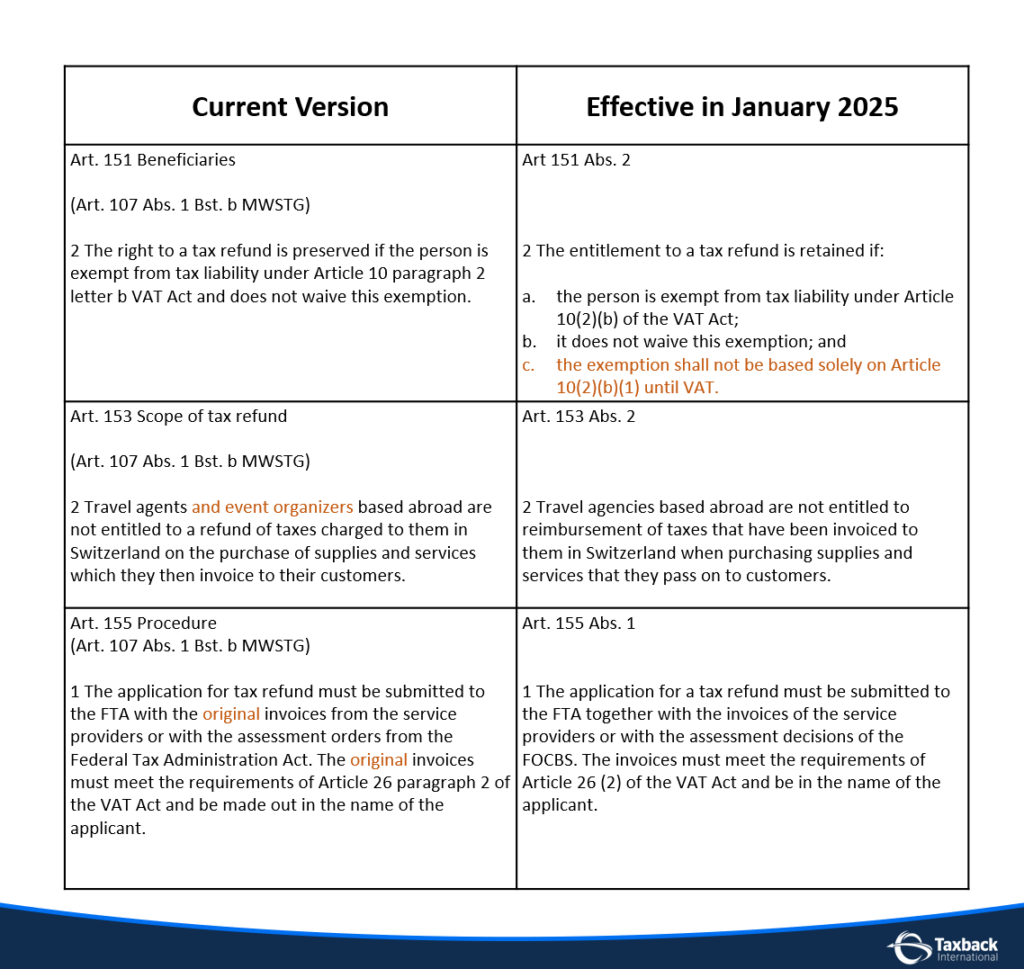

From January 2025, there will be some changes in the Foreign VAT Refund procedure.

The future version of the MWSTV (VAT Ordinance) was last modified on 21 August 2024 and published on Fedlex (The publication platform of federal law) on 9 September 2024.

Below is a summary of the changes and a comparison between both versions:

- Art. 151 (2) – Narrowing the entitlement to a VAT refund by excluding services mentioned in Art.10 (2) b.1. of the VAT Act – exempt benefits

- Art. 153 (2) – Expanding the scope of the VAT refund to event organizers

- Art. 155 (1) – Changing the invoice requirements by removing the word “original” in front of the word “invoices”

Thailand

Foreign Online Platforms

Thailand is proposing an update in its laws to require foreign online platforms to register for VAT.

This is part of a plan to better regulate online trade and stop illegal sales, following a government meeting led by Deputy Minister, Phumtham Wechayachai.

One key change is that both local and foreign online businesses must register as legal entities in Thailand and follow VAT rules.

The Revenue Department is also updating its tax laws to support this.

The government will increase customs inspections and checks on online products. It also plans to help small businesses improve and compete by supporting them in expanding their exports, especially to markets like China, Japan, and South Korea.

Tax on Low Value Goods

Thailand implemented temporary measures to tax low-value goods imported into the country.

These temporary measures were introduced on 5 July 2024 and are in effect until the end of the year.

- Nearly all imports are subject to import duty and VAT, regardless of their value;

- The Ministry of Finance plans to amend the Revenue code to impose VAT on LVGs valued between THB 1 and THB 1,500, however since the process is time consuming, Thai Customs has been directed to collect these taxes in the interim; and

- Goods with values over THB 1 but under THB 1,500 are subject to VAT.

These measures were enforced by Official Notifications issued on 19 June 2024 and on 5 July 2024

However, these measures are temporary and the final amendments to the Revenue Code are pending, and they will be in effect until 31 December 2024.

Foreign sellers targeting the Thai market through e-commerce must ensure VAT is paid by their logistics providers or the recipient in Thailand, depending on the delivery method.

Turkey

On the 25 September 2024, Communiqué Nr. 565 was published in the Turkish Official Gazette – Resmî Gazete, to end the submission of the Notification Forms Ba (Regarding Purchases of Goods and Services) and Bs (Regarding Sales of Goods and Services).

This change comes into effect from the 1 October 2024 with the starting period September 2024.

United Kingdom

In August 2024, HMRC released updated guidance to help Digital Economy businesses comply with specific reporting requirements, including how to cancel or make changes to a VAT One-Stop Shop registration.

The VAT OSS scheme applies to VAT on distance sales of goods from Northern Ireland to EU countries.

The guidance explains when to cancel or update registration details, what happens after cancellation, how to re-register for the scheme, and how to switch to an EU country’s OSS scheme, being registered in one country at a time. If you stop making OSS sales, you must notify HMRC and follow the regular VAT rules for Northern Ireland-EU sales.

A new section in VAT legislation also addresses the requirement to notify HMRC if your business no longer makes eligible sales. Full guidance is available on HMRC’s website.

Stay Up to Date with Our VAT Newsletter

To ensure you remain informed about the latest VAT news, trends, and topics from around the globe, subscribe to our VAT Newsletter. Each month, we deliver insightful updates straight to your inbox, helping you stay ahead of the curve.

Partner with Real VAT Experts

With decades of experience in VAT compliance and consultancy, our team at Taxback International stands ready to assist you. We offer comprehensive expertise across all countries and languages where VAT obligations exist.

Explore Cutting-Edge Solutions

In addition to our consultancy services, we’ve developed tailored technology solutions to address the VAT challenges confronting businesses today.

Here’s a glimpse of what we offer:

Comply: Our VAT Compliance platform ensures seamless adherence to VAT regulations.

VATConnect: Optimize VAT reclaim processes, both foreign and domestic, with our VAT Reclaim platform.

TBI Pay: Simplify cross-border payments using our streamlined technology solution.

Reach out to us today to discover how we can support your business’s VAT needs amidst evolving tax landscapes.