VAT Trends 2024: An Overview

The landscape of Value Added Tax (VAT) is undergoing significant changes, driven by the need to reduce the VAT compliance gap, evolving digital economies, and new regulatory frameworks. This blog post synthesizes the key findings from Chief Tax & Compliance Officer at Taxback International, Lisa Dowling’s recent presentation on VAT trends for 2024, highlighting the challenges and opportunities that lie ahead.

The VAT Gap

The VAT Gap represents the difference between the expected VAT revenue and the actual revenue collected. In 2021, the VAT gap in Europe was estimated at €61 billion, down from €99 billion in 2020. This decline can be attributed to several factors:

- Digitization: The adoption of real-time reporting and e-invoicing has improved compliance.

- Government Support: Economic measures during COVID-19 that were tied to tax compliance have also played a role.

- Shift to Cashless Payments: An increase in online shopping and cashless transactions has contributed to a more transparent VAT environment.

Countries like Italy and Poland have seen significant reductions in their VAT gaps, with declines of 10.7% and 7.8%, respectively. Conversely, Romania continues to struggle with a consistently high VAT gap. We will soon see what impact their recent roll out of e-invoicing and digital reporting will have.

The VAT Compliance Gap is a critical indicator of non-compliance, while the VAT Policy Gap reflects potential additional revenue that could be generated through uniform application of VAT rates. In 2021, the policy gap reached €1,125 billion, an increase of €75 billion from 2020, largely due to price inflation.

Key Findings:

- The average VAT policy gap across OECD countries was 19.2% in 2022.

- Temporary rate reductions during the pandemic have had lasting effects on compliance and revenue collection.

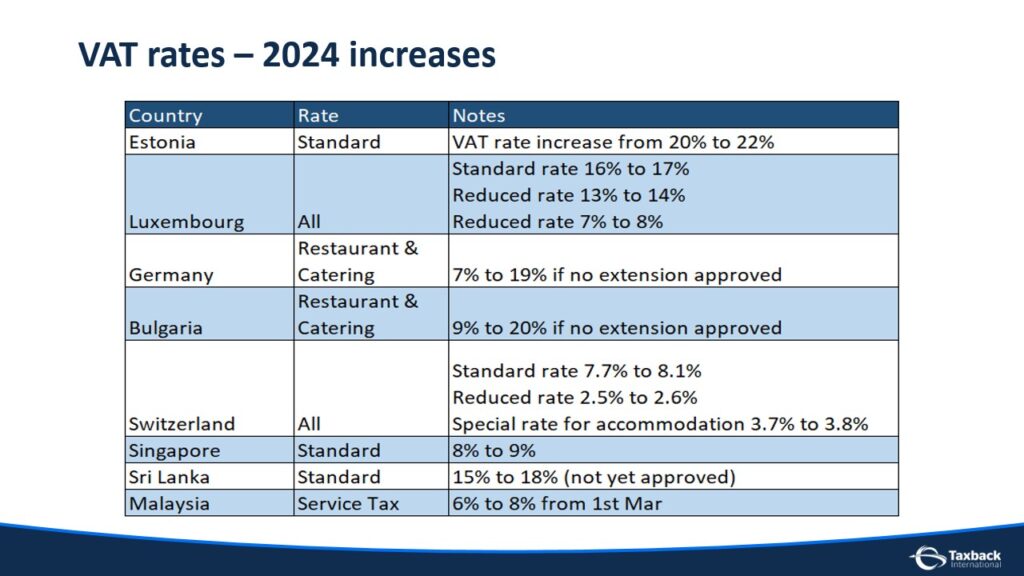

Trends in VAT Rates

In April 2022, the Council of the European Union adopted the Reduced VAT Rates Directive, allowing member states greater flexibility in applying reduced or zero rates on specified supplies. This directive aims to:

- Support climate goals.

- Reduce VAT avoidance.

- Harmonize VAT rates across member states.

For example, Ireland has implemented a zero VAT rate on solar panels effective May 1, 2023.

The Platform Economy and VAT Obligations

The rise of the platform economy has led to increased VAT obligations for online marketplaces. Following the 2021 E-Commerce Reform, platforms are now deemed responsible for collecting VAT on certain transactions facilitated through their services. This shift aims to level the playing field between traditional suppliers and platform-based services.

Future Developments:

- The ViDA (VAT in the Digital Age) initiative extends these obligations further, with an implementation date potentially set for July 1, 2027.

- Over 100 countries have implemented VAT/GST obligations for non-resident suppliers of digital services, increasing domestic VAT obligations globally.

Digital Services Transitioning to Remote Services

The evolution from “digital services” to “remote services” is becoming evident as countries like Australia and Singapore introduce regulations taxing all B2C supplies of remote services. The OECD recommends that foreign service providers register for VAT where their customers are located.

Upcoming Changes:

- Real-time reporting based on e-invoicing will become standard, with pre-populated VAT returns expected as a result.

- Countries like Italy, Hungary and Romania have already introduced pre-filled returns based on e-invoicing data.

Conclusion: The Future of VAT Reporting

As we move towards more automated systems for VAT reporting and compliance, businesses must adapt to new regulations and technologies. The focus will increasingly be on:

- Enhancing compliance through digital solutions.

- Navigating complex cross-border transactions.

- Addressing challenges such as mismatches in documentation.

The landscape of VAT is changing rapidly, and staying informed about these trends is crucial for businesses operating within this framework. By understanding these dynamics, companies can better prepare for future regulatory changes and optimize their tax strategies accordingly.