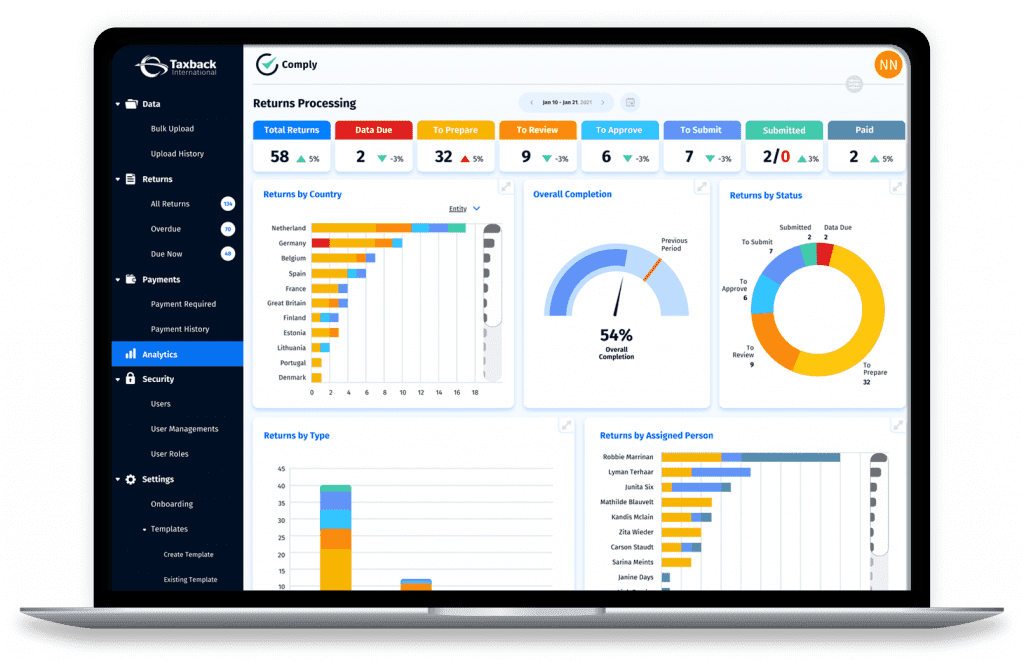

What is Comply?

Comply is our innovative VAT compliance platform that streamlines the preparation and filing of VAT returns, eliminating the complexities of manual reporting that often result in non-compliance.

With Comply, your data undergoes thorough scrutiny, ensuring error-free returns ready for approval and submission to relevant tax authorities. Our platform effortlessly handles country-specific regulations and requirements with its intelligent automation. Comply offers invaluable trend analysis and precise financial forecasting, safeguarding your business’s future earnings. Through our groundbreaking integrated payments technology, timely cross-border tax office payments are facilitated in local currencies, ensuring seamless transactions.