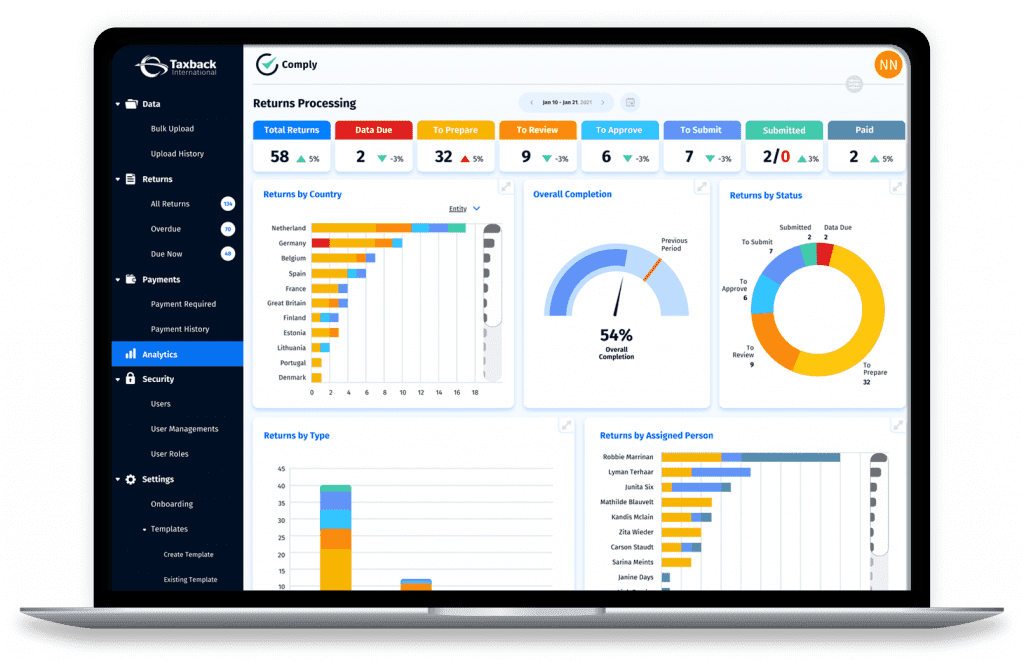

What is Comply?

Comply is our innovative VAT compliance platform that offers end-to-end managed process for all VAT filings, giving you full visibility and control over all global VAT compliance obligations. Our platform effortlessly handles country-specific regulations and requirements. Comply supports:

- VAT Registrations

- VAT De-registrations

- Intrastat and EC Sales Listings