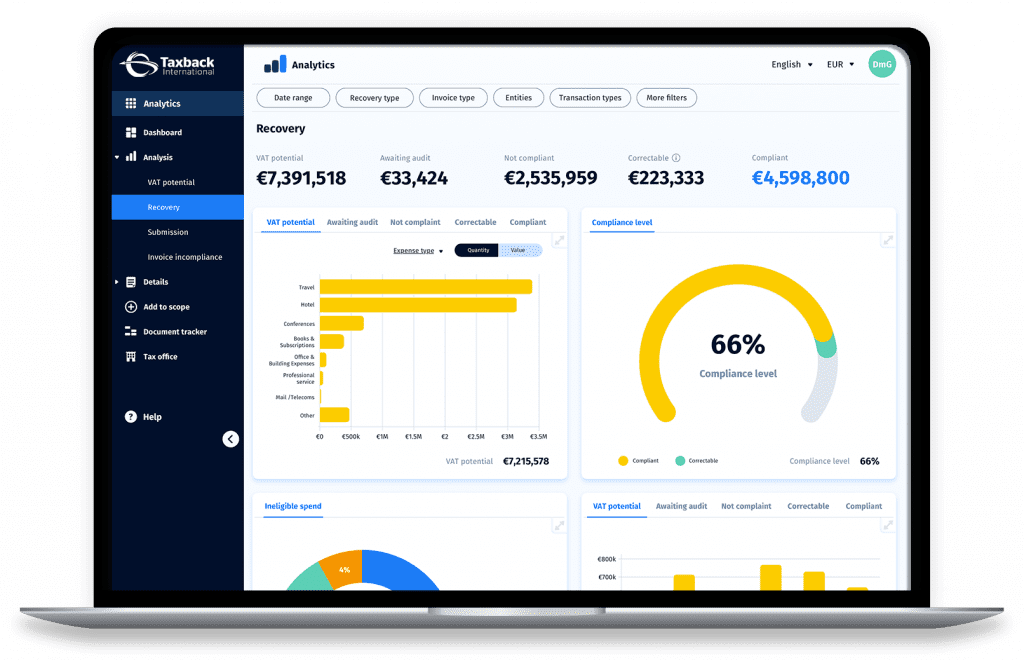

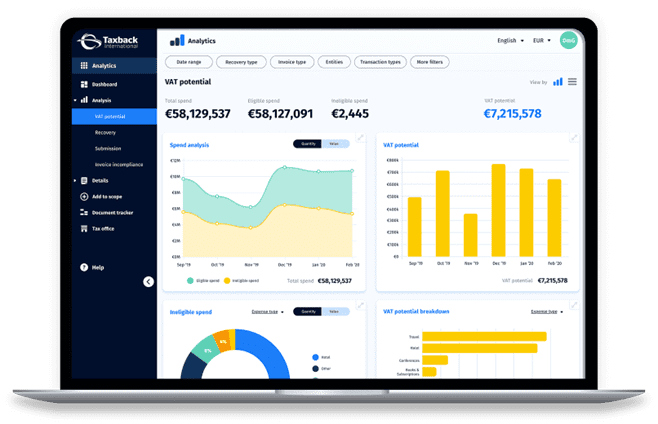

What is VATConnect?

VATConnect is a secure cloud-based platform designed to optimise VAT reclaim for both Foreign and Domestic VAT Reclaim processes. With VATConnect, every transaction with VAT recovery potential is identified and streamlined into the reclamation process. Through seamless integration with Expense Management Systems, VATConnect accurately identifies potential VAT recovery opportunities. By eliminating submission errors and ensuring compliance with tax office regulations, VATConnect not only simplifies the VAT reclaim process but also maximises the value of VAT reclaims for businesses.