European Union: Various Changes to Forms & Intrastat Thresholds

Various Changes to Forms

Germany

The German Tax Authorities published the Regular VAT return applicable for reporting periods starting from 1 January 2023.

Below is a synopsis of the changes:

- Additional lines are added in order to include the 0%:

- Line 14 – Sales at the reduced tax rate of 0% are to be entered in line 14:

- A reduced tax rate of 0% only applies to the supply and installation of solar modules to the operator of a photovoltaic system, including the components essential for the operation of a photovoltaic system and the storage devices used to store the electricity generated by the solar modules when the photovoltaic system is on or installed in the vicinity of private dwellings, flats, public and other buildings used for activities of general interest. The requirements are met if the installed gross power of the photovoltaic system is not or will not be more than 30 kW (peak) according to the market master data register.

- Line 26 – Intra-community acquisitions at the reduced tax rate of 0% are to be entered in line 26:

- Only intra-community acquisitions of solar modules are subject to a reduced tax rate of 0%. This includes the components essential for the operation of a photovoltaic system and the storage devices used to store the electricity generated by solar modules if the photovoltaic system is on or near private residences, dwellings and public and other buildings used for activities serving the public interest. The requirements are met if the installed gross power of the photovoltaic system is not or will not be more than 30 kW (peak) according to the market master data register.

- Lines with changed meaning:

- Line 17:

- Taxable sales of alcoholic liquids (e.g. wine) and of sawmill products and beverages not listed in Annex 2 to the UStG must be entered in line 17. The average rates to be applied to the respective basis of assessment in line 17 (section 24 paragraph 1 sentence 1 number 2 UStG; in the calendar year 2023: 19%) are around the rates for flat-rate input tax amounts current at the time of the transaction (section 24 paragraph 1 sentence 3 in conjunction with Sentence 1 number 2 UStG). The percentage calculated thereafter is to be applied to the assessment basis and the result entered as the tax amount

- Line 41:

- Amounts determined according to an average rate (§ 23a UStG) for corporations, associations of persons and assets within the meaning of § 5 paragraph 1 number 9 Corporation Tax Act, whose taxable turnover, with the exception of imports and intra-community acquisitions, did not exceed €45,000 in the previous calendar year and who are not required to keep accounts and make regular financial statements based on annual inventories.

Germany – Annual Return for 2023

On 21 December 2022, the German Ministry of Finance published the updated form of the 2023 annual return.

The return is modified as to reflect the changes applicable from 1 January 2023. These changes include:

- The introduction of zero-rating on supplies, and intra-Community acquisitions on the importation and installation of certain solar modules, including those essential for the operation of a photovoltaic system introduced by Annual Tax Act 2022 Jahressteuergesetzes 2022 (JStG 2022) from 16 Dec 2022;

- certain changes in the flat-rate scheme applicable to the agriculture and forestry sector;

- changes in an input tax deduction in some specific cases

- phasing out input tax flat rate according to general average rates;

- increase of the threshold to claim input tax flat rate in certain cases(§ 23a UStG) – to EUR 45,000.

Italy

On 15 December 2022, the Italian Tax Authorities announced that the Annual return 2023 (IVA 2023) to be used concerning the tax year 2022 has been updated to accommodate the regulatory changes of 2022.

The main changes, of a general nature, introduced in the VAT/2023 return forms are described in the Instructions for completing the form.

Spain

By Order HFP/1124/2022, the Spanish tax authorities introduce the VAT reporting forms applicable for periods starting 1 January 2023 (periodic returns Modelo 303, Modelo 322 and annual return (Modelo 390). This reflects the changes in tax rates introduced in the VAT Law by the third final provision of the Law of waste and contaminated soils for a circular economy and by article 18 of Royal Decree-Law 11/2022, of June 25, which adopted and extended certain measures to respond to the economic and social consequences of the war in Ukraine, to face situations of social and economic vulnerability, and for the economic and social recovery of the island of La Palma.

The Order enters into force on January 1, 2023. Updated versions of Form (Modelo) 303 and 322, to be used for periods that begin on or after January 1, 2023, and the annual summary statement, model 390, corresponding to the year 2022.

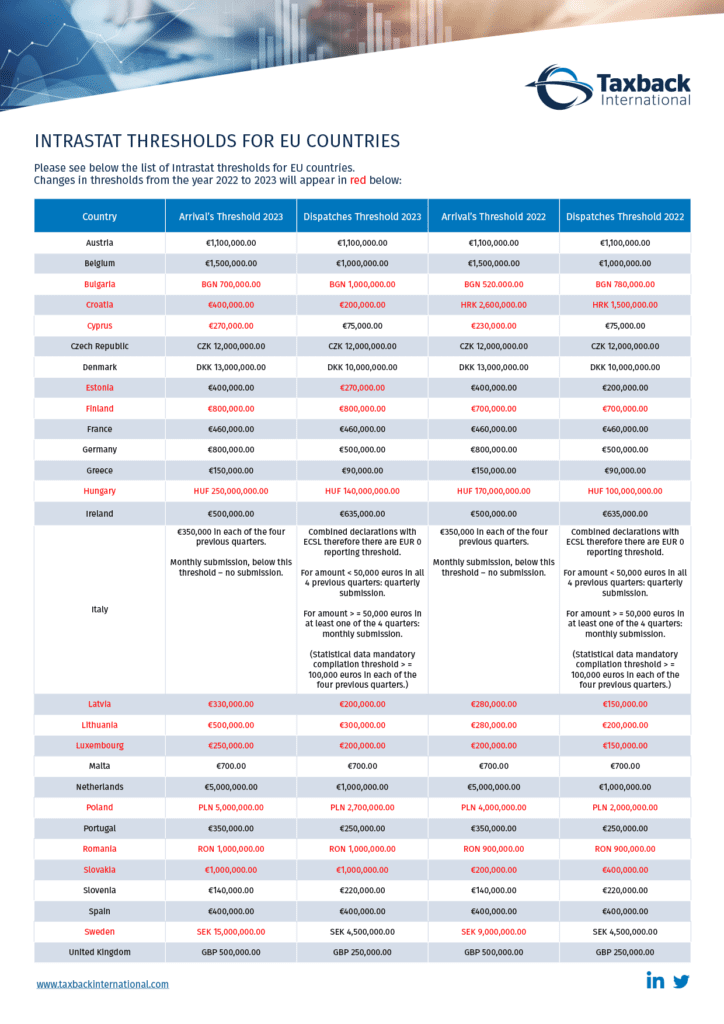

Intrastat Thresholds applicable for 2023 as currently published by the relevant authorities

Please see below the list of Intrastat thresholds for EU countries.

Changes in thresholds from the year 2022 to 2023 will appear in red below:

Stay Up to Date

Each month we feature the latest news trends and topics covered by our TBI experts. For more regular news and regulatory updates follow us on LinkedIn and Twitter.

Work with real VAT experts

With over 25 years of experience in the area of VAT compliance and consultancy, we handle all countries and languages where VAT obligations exist. We have a dedicated & centralized team of VAT experts, with a reputation of excellence within all global tax offices ready to speak to you about your VAT obligations.

Taxback International

For over 25 years Taxback International has been a world leader in VAT consultancy and compliance providing expert support to more than 12,000 global clients including Apple, Google, IBM, and Twitter.

With increasing digitalization of global tax processes, we have developed tailored technology solutions to solve challenges facing companies today.

- Comply – End-to-end VAT compliance platform.

- TBI Pay – Streamlined cross-border payments technology.

- VAT Connect – Cloud-based, automated review of transactional data and images via AI and Machine Learning for Domestic and Foreign VAT Reclaim.